Property Tax Bill Update

The Halifax Regional Municipality has made changes to the property tax bill format and is providing additional ways to communicate about your account.

For all other information about your property tax, click here. For information about how the property tax bill is determined, click here.

Changes include:

- new property tax bill format

- new options to communicate about your tax bill

- account number update (which will mainly impact residents who pay via online banking)

- changes to your property tax bill amount

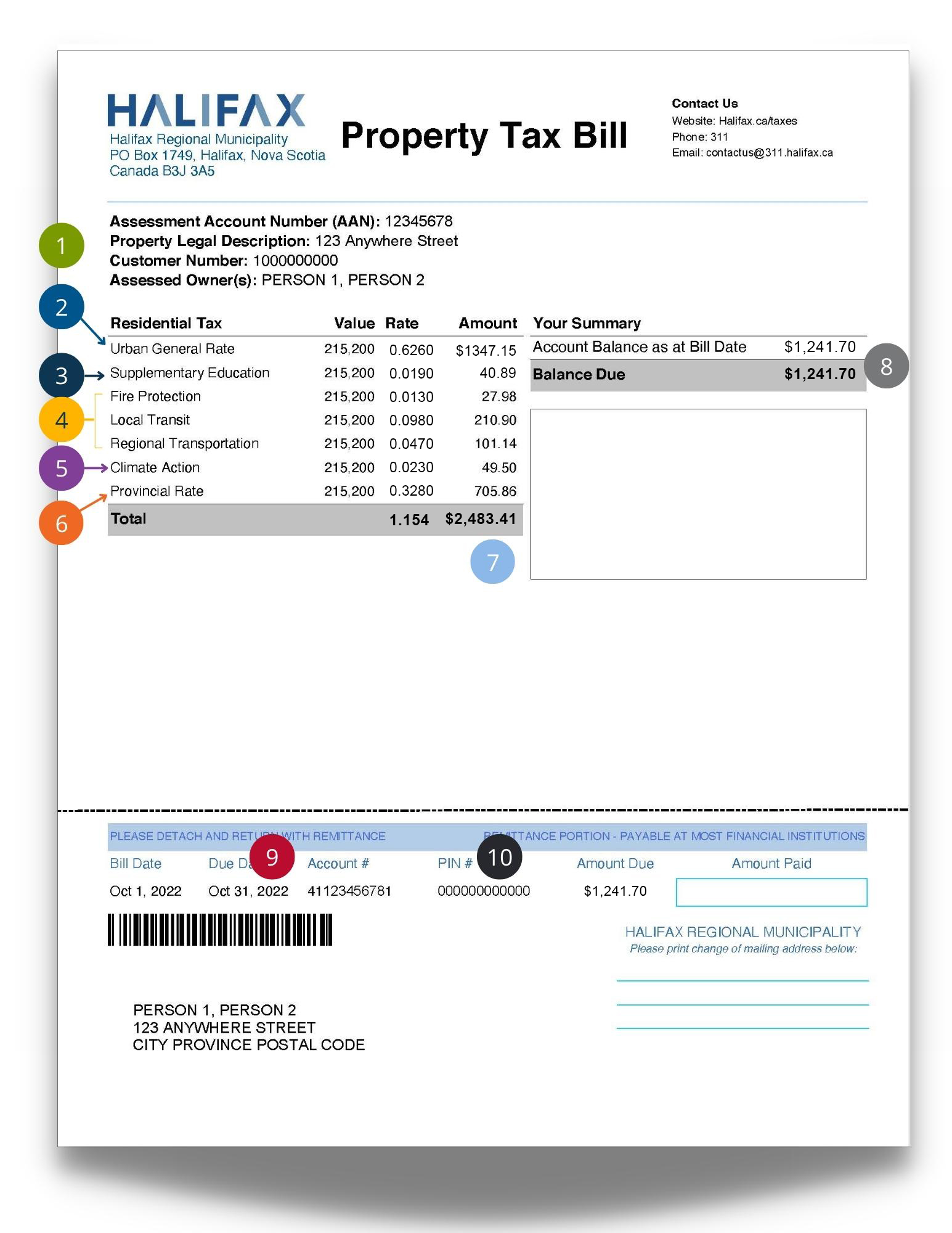

Legend:

- Property description

- Assessment Account Number

- Property Legal Description

- Customer number

- Assessed Owner(s): Person 1, Person 2

- General tax rate – funds the various services the municipality provides, such as policing, solid waste, recreation programs, libraries and sports fields. The charge on your property tax bill will be listed as urban, suburban or rural, depending on where you live

- Supplementary education rate – used to supplement funding to the Halifax Regional Centre for Education (HRCE) and the Conseil Scolaire Acadien Provincial (CSAP), the province-wide Acadian school board, for programs within the Halifax region

- Area charges – fund specific services in your area and vary depending on where you live. Area charges include:

- Fire protection – the Nova Scotia Utilities and Review Board (NSUARB) requires the municipality to make a contribution to fund the operations of the Halifax Water. This contribution is used to fund the hydrant costs incurred by Halifax Water and is set by a formula approved by the NSUARB. The hydrant charges are recovered via a special fire protection area rate that the municipality levies on all properties within 1,200 feet of a hydrant available for public fire protection. Check the fire protection area map [PDF] to see if this applies to your property.

- Local transit – the boundary for the Local Transit area includes all properties within one kilometre walking distance of any HRM transit stop. This includes conventional transit, park and rides, regional express, ferry terminals, and any other HRM transit stop. Refer to the local transit mapped area to see how your property is affected.

- Climate action – The climate action tax funds projects and programs supporting HalifACT outcomes, including both climate mitigation efforts and adaptation – improving municipal resiliency – with major projects ranging from electrification of buses to retrofitting of existing municipal buildings. With this tax, the approved budget funds the 3-Year Resource Plan outlined in the HalifACT 2020/21 Annual Report provided to Halifax Regional Council December 15, 2021.

- Provincial rate – collected by the municipality on behalf of the Province of Nova Scotia

- Total property taxes for the current year

- Balance due – current amount owing

- Payment due date

- PIN number – required for email/SMS registration